CSS Forums

Thursday, April 25, 2024

05:48 AM (GMT +5)

05:48 AM (GMT +5)

|

|||||||

|

Share Thread:

Facebook

Facebook

Twitter

Twitter

Google+

Google+

|

|

|

LinkBack | Thread Tools | Search this Thread |

|

#1

|

||||

|

||||

|

THE INSTITUTE OF BANKERS PAKISTAN Q.1 Please write the alphabet of the selected answer in the given space: ISQ Examination (Summer-2011) ACCOUNTING FOR FINANCIAL SERVICES Q.2 List 04 revenue and expenditure items for financial institutions. Q.3 List 2 off balance sheet items for financial institutions. Q.4 The following financial statements are from the 2010 Annual Report of the Niagara Company:  Required: Cash Flow statement by using Indirect Method Q.5 Explain the closing process through “expense and revenue summary account”. Q.6 Identify which general accounting principle best describes each of the following practices: (a) Mr. Ali owns both beverages and tourism services. In preparing financial statements for tourism services, Mr. Ali makes sure that the expense transactions of beverages are kept separate from tourism’s statements. (b) In December, 2010, A-Plus Floors received customer’s order and cash prepayments to install carpet in a new house that would not be ready for installation until March, 2011. A-Plus Floors should record the revenue from the customer order in March 2011, not in December, 2010. (c) If Rs 30,000 cash is paid to buy land, the land is reported on the buyer’s balance sheet at Rs 30,000. (d) A telecommunication company sells talk time through scratch cards. No revenue is recognized when the scratch card is sold, but it is recognized when the subscriber makes a call and consumes the talk time. Q.7 The following balances are extracted from the books of M/s . Asrar & Bros at December 31, 210. Cash - Rs 3,950 Supplies - Rs 9,720 Prepaid Insurance - Rs 2,400 Equipment - Rs 26,000 Account Payable - Rs 6,200 Unearned Consulting Revenue - Rs 3,000 Capital - Rs 30,000 Withdrawals - Rs 600 Consulting Revenue - Rs 5,800 Rental Revenue - Rs 300 The following transactions need to be adjusted as on December 31, 2010. (a) Remaining unused supplies are Rs 8,670. (b) Depreciation expense for the period is Rs 375. (c) Insurance expired during the period Rs 100 (d) Rs 250 consulting revenue have been earned from the unearned consulting revenue. (e) Unpaid salaries Rs 210. (f) Accrued consulting revenues Rs 1,800. Required: A) Prepare the adjusted trial balance at December 31, 2010. B) Prepare work sheet for the period ended on December 31, 2010. Q.8 The following information relates to transactions between a company and its customers.

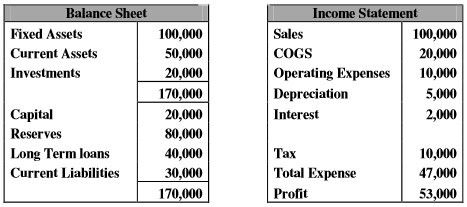

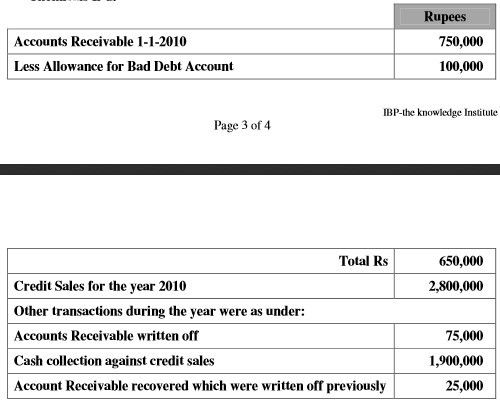

Q.9 Table shows the balance sheet and income statement of ABC ltd. As on 31st December, 2010.  Required: Compute Return on Capital Employed (ROCE). Q.10 The following information is collected of accounts receivable of M/s Modern Chemicals Ltd.  A) Accounts Receivable outstanding as on 31st December, 2010. B) The management estimates that 1.5% of its credit sales will prove to be uncollectible. Make provision under income statement approach. C) Pass journal entry for the amount of provision computed at (B) above and prepare a T account showing the balance which will appear against Allowance for Bad Debt Account at the close of the year. -.-.-.-.-.-

|

|

«

Previous Thread

|

Next Thread

»

|

|

Similar Threads

Similar Threads

|

||||

| Thread | Thread Starter | Forum | Replies | Last Post |

| [Summer] 2011: Business Communication for Financial Services | Last Island | 2011 | 0 | Wednesday, May 06, 2015 06:46 PM |

| [Winter] 2011: Marketing of Financial Services | Last Island | 2011 | 0 | Wednesday, May 06, 2015 05:31 PM |

| The Types Of Accounting | pakfame | Accounting & Auditing | 0 | Saturday, February 23, 2008 03:41 PM |