CSS Forums

Thursday, April 25, 2024

10:35 AM (GMT +5)

10:35 AM (GMT +5)

|

|||||||

|

Share Thread:

Facebook

Facebook

Twitter

Twitter

Google+

Google+

|

|

|

LinkBack | Thread Tools | Search this Thread |

|

#1

|

||||

|

||||

|

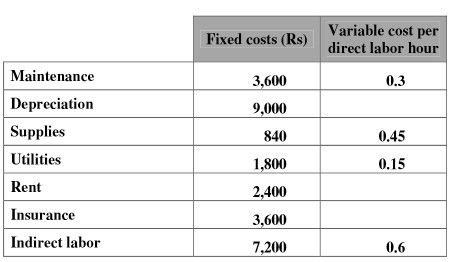

THE INSTITUTE OF BANKERS PAKISTAN ISQ Examination (Summer-2011) MANAGEMENT ACCOUNTING FOR FINANCIAL SERVICES Q.1 Please write the alphabet of the selected choice in the answer column: Q.2 A) Cost volume profit (CVP) analysis is the study of the interrelationships between costs, volume and profits on various levels of activity. Explain at least 5 limitations of CVP analysis. B) A company produces basketball fixtures, which retails for $ 420 per unit. This year a gross profit of 30% of the cost of good sold was made on the 3000 units sold. Materials were 50% and labor cost 30% of the current cost of goods sold. Next year it is expected that materials and labor costs will increase by 20% per unit and factory overhead will increase by 15% per unit. A new selling price of $ 500 has been established to meet rising costs. Compute the number of units that must be sold next year to make the same gross profit as this year. Q.3 A) Tasty Corporation manufactures chocolate candy bars. It requires 2,000 pounds of raw materials to produce 1,500 pounds of chocolate candy. standard product quantities are: 1,000 pounds of cocoa @ $ 0.75 per pound, 600 pounds of sugar @ $ 0.60 per pound and 400 pounds of corn Syrup @ $ 0.50 per pound. Compute the input price per pound and the output price per pound: B) Define process costing. Describe its features. Q.4 A) When opening stocks were 8,500 liters and closing stocks 6,750 litres, a firm had a profit of Rs 62,100 using marginal costing. Assuming that the fixed overhead absorption rate was Rs 3 per litre, what would be the profit using absorption costing? B) The budgeted variable cost per unit was Rs 2.75 when output was 18,000 units, total expenditure was Rs 98,000 and it was found that fixed overheads were Rs 11,000 over budget while variable costs were in line with budget. What was the amount budgeted for fixed costs? Q.5 A) A unit of product X requires 24 active labour hours for completion. It is anticipated that there will be 25% idle time which is to be incorporated into the standard time for all products. The wage rate is Rs 10 per hour. What is the standard labor cost of one unit of product X? B) Rahil Limited makes two products, A and B, for which there is unlimited sales demand at the budgeted sales price of each. Product A takes 3 hours to make, and has a variable cost of Rs 18 and a sales price of Rs 30. Product B takes 2 hours to make, and has a variable cost of Rs 10 and a sales price of Rs 20. Both products use the same type of labour, which is in restricted supply. Determine which product should be made in order to maximize profits. Q.6 A) A project requires initial investment of Rs 85,000 and is expected to give cash flow of Rs 18,000, Rs 25,000, Rs 10,000, Rs 25,000 and Rs 30,000 for five years. The project has a salvage value of Rs 10,000. The company’s target rate of return is 10 percent. Calculate the profitability of the project by using profitability index method. B) A company is evaluating a proposal to acquire a new plant for its production department. The cost of the plant is Rs 450,000. The plant has a useful life of 10 years and is expected to yield an annual profit of Rs 75,000 after depreciation but before tax. Depreciation and tax is charged at 10 percent and 40 percent respectively. Compute the payback period. Q.7 Annas Company wants to prepare flexible budget cost estimates for the following items within a range of 10,000 to 12,000 direct labor costs:  A) Prepare a flexible overhead budget for 10,000, 11,000, and 12,000 direct labor hours. B) Calculate the fixed, variable, and total predetermined overhead rates if 10,000 direct labor hours are chosen as normal capacity. C) Calculate the fixed, variable, and total predetermined overhead rates if 12,000 direct labor hours are chosen as normal capacity. -.-.-.-.-.- |

|

«

Previous Thread

|

Next Thread

»

|

|

Similar Threads

Similar Threads

|

||||

| Thread | Thread Starter | Forum | Replies | Last Post |

| Essay on "Disaster management in Pakistan" | khalid hanif | Essay | 8 | Tuesday, August 01, 2023 09:37 PM |

| current affair for asi preparation | salamrodnani | SPSC Other Examinations | 20 | Saturday, October 11, 2014 01:00 AM |

| Pakistan Economy -an overview | Mir khetran | Current Affairs | 0 | Monday, November 26, 2012 11:48 PM |

| Repeated Questions of Forestry | Last Island | Forestry | 0 | Saturday, December 03, 2011 07:24 PM |